Turn Downtime into Growth: Practical Tips for Small Business Owners

As a business owner, you're used to the hustle—juggling multiple responsibilities, solving problems, and keeping the business moving forward. But...

Actionable insights on payroll, taxes, cash flow, leadership, and growth planning — all focused on real-world decisions and better outcomes.

Join for the insights. Stay for the “oh, that actually helped.”

As a business owner, you're used to the hustle—juggling multiple responsibilities, solving problems, and keeping the business moving forward. But...

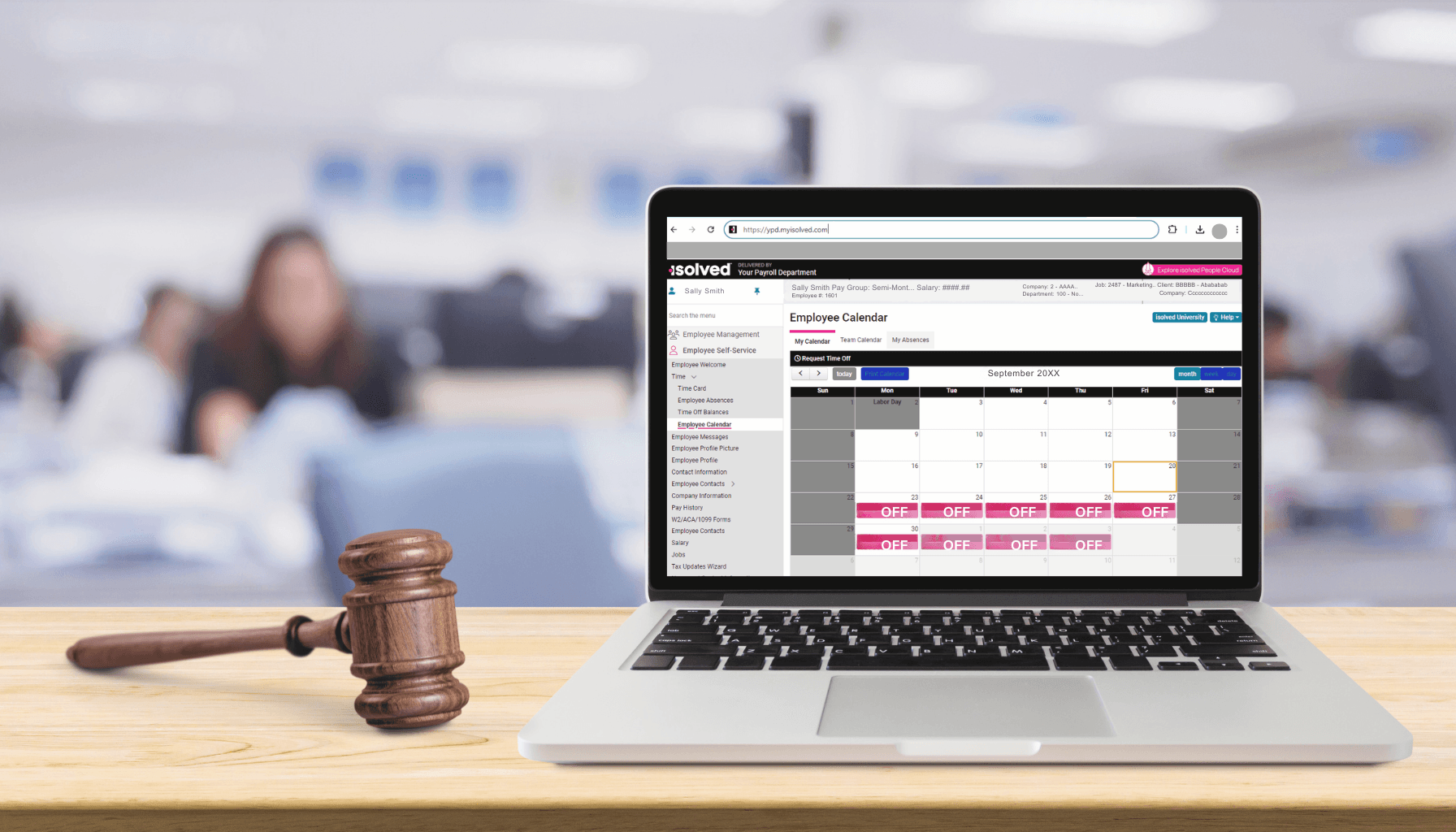

Paid leave laws have become a critical aspect of employee benefits, especially for small to medium-sized businesses (SMBs). These laws are designed...

In today’s fast-paced business environment, small and medium-sized businesses are constantly seeking ways to streamline operations and reduce costs....

As a CPA, I've witnessed the highs and lows of various businesses. Some soar to incredible heights, while others face the unfortunate reality of...

As a business owner, payroll is undoubtedly one of the most critical aspects of your company. It’s not just about paying your employees; it’s also...

As a small to medium-sized business owner, managing payroll can seem manageable at first. After all, how hard can it be to cut a few checks every...

When it comes to running a business, one of the last things you want is to attract the attention of the IRS. Unfortunately, certain common tax...

As a small or medium-sized business owner, you’re likely always looking for ways to gain an edge over your competition. Just as in sports, where...

Mike Michalowicz, the author of the book Profit First and founder of the Profit First Method, developed a comprehensive training and certification...

Developing a budget is a crucial aspect of running a successful business. A budget provides a roadmap for allocating resources, making informed...

You might be asking yourself "Is ERC is still even available in 2024??" While the program is no longer accepting new claims for wages paid in 2020,...

Forming strategic partnerships can be a game-changer for small businesses and entrepreneurs. These alliances allow you to leverage the expertise,...